Investing is often perceived as a complex and intimidating endeavor reserved for the wealthy. Many individuals mistakenly believe that substantial capital is required to enter the investment world. However, with as little as 100 dollars, anyone can begin their investment journey.

The Importance of Starting Early

Time is Your Greatest Asset

One of the most compelling reasons to start investing early, even with a small amount like 100 dollars, is the power of compound interest. Compounding allows your investments to grow exponentially over time. The earlier you start, the more time your money has to grow, making small initial investments potentially worth significantly more in the future.

For example, if you invest 100 dollars today and achieve an average annual return of 7 percent, you will have approximately 200 dollars after 10 years. If you wait 10 years to invest that same 100 dollars, those potential earnings are lost.

Developing Good Financial Habits

Starting with a small investment helps cultivate healthy financial habits. By engaging in investing early, you learn the basics of managing your money, budgeting, and understanding market dynamics. These skills are invaluable for achieving long-term financial success.

Overcoming Fear and Building Confidence

Many people avoid investing altogether due to fear and uncertainty. By starting with a manageable amount, you can ease into the process and gradually build your confidence. As you become more familiar with investing concepts, you may be encouraged to invest additional funds.

The Benefits of Investing With 100 Dollars

Accessibility

With the advent of technology and financial apps, investing has become more accessible than ever. Many platforms allow you to start investing with as little as 100 dollars. This accessibility democratizes wealth-building opportunities for individuals who may not have large sums of money to invest.

Diversification Opportunities

Investing in low-cost index funds and exchange-traded funds (ETFs) allows you to diversify your investment even with a small amount of money. Diversification minimizes risks by spreading your investments across various assets, reducing the impact of poor performance in any single asset.

Learning Experience

Starting with a small investment provides an excellent opportunity to learn about the markets and investment strategies. You can gain valuable insights about different asset classes, market behaviors, and risk management without significant financial exposure.

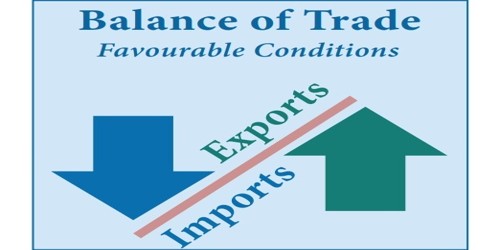

Adapting to Market Conditions

Starting with a smaller investment allows you to experiment with various investment strategies. You can explore different asset allocations, sector performances, and styles of investing. This enables you to adapt your approach based on market conditions and personal preferences.

Investment Options for Beginners

If you are ready to start investing with your 100 dollars, here are some options to consider:

1. Stock Market Investments

Investing directly in stocks is an option even for small amounts. Many brokerage firms do not require minimum deposits and offer commission-free trading options. Consider purchasing fractional shares, which allow you to invest in high-value stocks by buying a portion rather than a full share.

Benefits:

- Potential for high returns

- Ownership in profitable companies

- Dividends as a source of income

2. Exchange-Traded Funds (ETFs)

ETFs are a popular choice for beginners looking to diversify their investments. They are similar to mutual funds but trade like stocks on exchanges. With 100 dollars, you can invest in an ETF that holds a variety of stocks, bonds, or commodities.

Benefits:

- Instant diversification

- Low expense ratios

- Flexibility in buying and selling

3. Robo-Advisors

Robo-advisors are automated investment platforms that create and manage a diversified portfolio for you based on your risk preferences and financial goals. Many robo-advisors have low minimum investment requirements, making them ideal for those starting with 100 dollars.

Benefits:

- Hands-off investment management

- Smart diversification strategies

- Automated rebalancing

4. High-Interest Savings Accounts

If you are hesitant to invest in the stock market but still want your money to grow, consider a high-interest savings account. These accounts offer higher interest rates than traditional savings accounts, providing a safe and accessible option for your 100 dollars.

Benefits:

- Low risk

- Easy access to funds

- Interest accrual without market exposure

5. Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments. While this option carries risks, it can provide an opportunity to generate passive income with relatively small amounts of capital.

Benefits:

- Potential for higher returns

- Diversification within fixed-income investments

- Ability to support borrowers directly

How to Effectively Invest 100 Dollars

Step 1: Set Clear Financial Goals

Before investing, take time to define your financial goals. Are you saving for retirement, a short-term purchase, or simply looking to grow your wealth? Establishing clear goals will help inform your investment strategy.

Step 2: Choose the Right Investment Platform

Selecting the right investment platform is crucial. Research brokerage accounts, robo-advisors, and investment apps to find one that aligns with your needs. Look for low fees, user-friendly interfaces, and educational resources.

Step 3: Create a Diversified Portfolio

Even with just 100 dollars, aim to create a diversified portfolio that includes a mix of asset classes. Consider allocating funds to stocks, bonds, and other options to minimize risk while maximizing potential returns.

Step 4: Start Small and Focus on Consistency

Begin by investing your 100 dollars and set a plan for contributing regularly. Try to invest a small amount each month, even if it is just an additional 10 or 20 dollars. Consistent contributions will help grow your investment over time.

Step 5: Monitor Your Investments and Stay Informed

After investing, regularly review your portfolio and stay informed about market trends. Monitor your investments to ensure they align with your goals and make adjustments as necessary.

Step 6: Keep Emotions in Check

Investing can be emotional, especially during market fluctuations. Avoid making impulsive decisions based on fear or greed. Maintain a long-term perspective and stay focused on your financial goals.

Overcoming Common Challenges

1. Lack of Knowledge

Many potential investors feel overwhelmed by a lack of knowledge about investing. To combat this, take advantage of educational resources such as books, online courses, podcasts, and blogs related to personal finance and investing.

2. Fear of Losing Money

Fear of loss can prevent individuals from starting to invest. Understand that investing inherently carries risks, but over the long term, it often yields greater returns than keeping money in a traditional savings account. Start by investing small amounts to build confidence.

3. Market Volatility

Market volatility can be unsettling for novice investors. Recognize that market fluctuations are normal and can present opportunities for long-term investors. Focus on your investment strategy and avoid reacting impulsively to short-term market movements.

Real-Life Examples of Investing With 100 Dollars

Example 1: Starting a Stock Portfolio

Jessica had always wanted to invest in stocks but felt she needed thousands to start. After reading about the benefits of starting small, she decided to invest 100 dollars in a low-cost index fund. Over the years, Jessica contributed regularly and watched her investment grow, ultimately serving as a foundation for a diversified portfolio.

Example 2: Utilizing a Robo-Advisor

Mark was new to investing and unsure of how to manage his money. He decided to invest his 100 dollars with a robo-advisor. The platform created a diversified portfolio tailored to his risk tolerance. Over time, Mark added more money to his account, benefiting from automated rebalancing and investing strategies.

Example 3: Earning Through Peer-to-Peer Lending

Alex wanted to explore peer-to-peer lending and invested 100 dollars in a lending platform. By spreading his investment across several borrowers, he minimized risks and earned interest payments. This unique approach helped him diversify his previously conservative investment strategy.

Conclusion

Investing does not require vast sums of money to begin. With just 100 dollars, anyone can embark on a journey towards financial growth and security. Starting early, developing good financial habits, and taking advantage of various investment options can lead to significant wealth accumulation over time.

Whether you choose stocks, ETFs, robo-advisors, or peer-to-peer lending, the critical factor is to start investing and remain committed to your financial goals. Remember that every dollar invested today is a step closer to a more secure and prosperous financial future.

As you navigate your investment journey, be patient and resilient. The world of investing offers countless opportunities, and starting with just 100 dollars can set the stage for long-term success.

Related

-

Financial News

-

Cryptocurrency

-

-

Forex Market

-

Economic Indicators

-

Forex Market